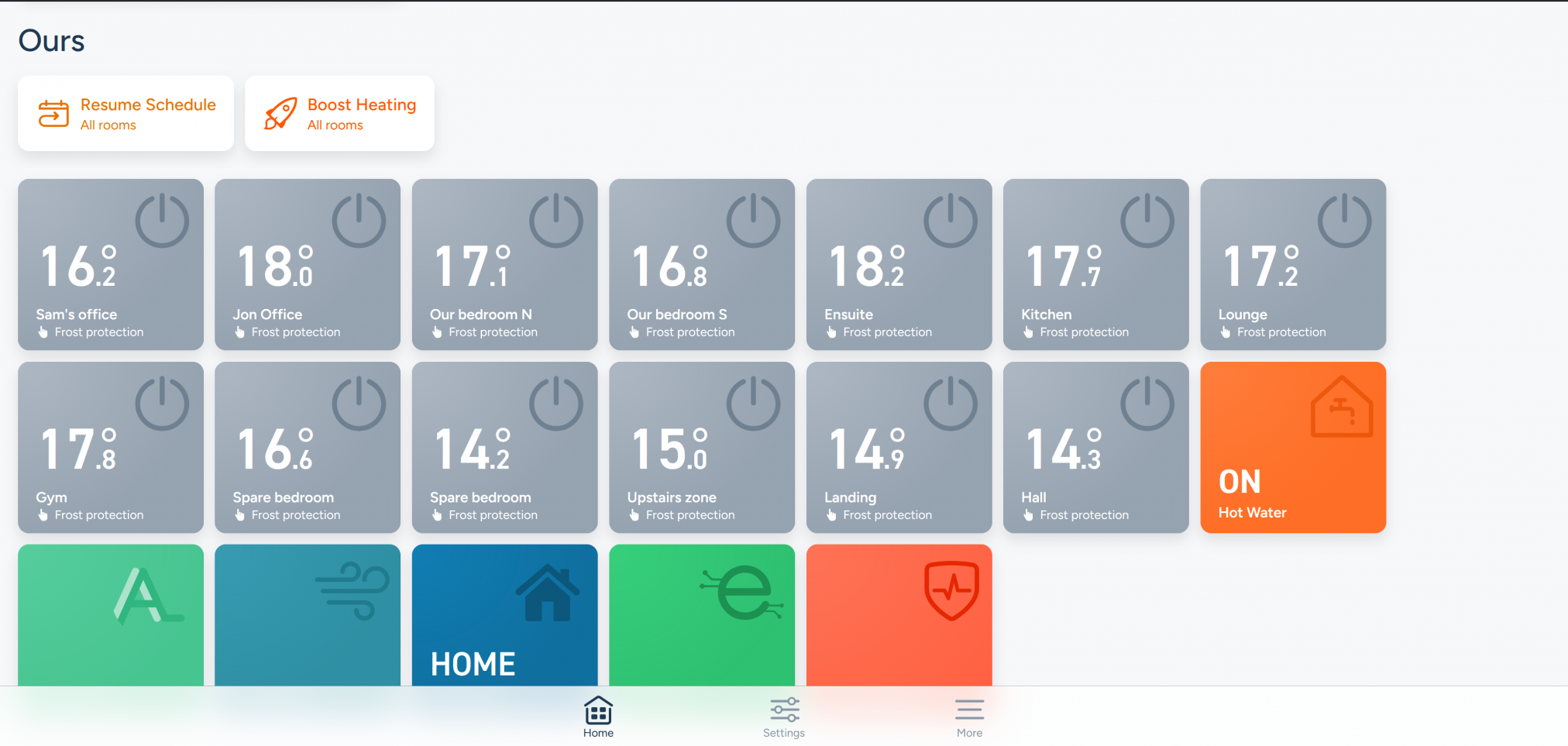

A fully dressed window.

This is a bit of a departure from my normal sort of post, but with the changes going on in our place, I wanted to cover making a house a home.

Over the years, there have been many articles written in many types of publications (like this one) and TV shows talking about style, sometimes about insulation, sometimes about other considerations.

But can I be brutally honest, please?

In a bedroom, you may want some blinds for extra light control or privacy, but nothing is as cozy or insulating as a pair of curtains.

My beloved and I had to swap some light busting venetian blinds in our gable end window in our bedroom to fit a French door in a few weeks. What a difference it has made. My beloved is a wiz at putting up shelves and curtains, so having bought the pole and ready made curtains, he did the honours and he hung them yesterday (about a half hour planning task and about an hour to do).

Swapping dark blinds for “soft-white” curtains means we have a “reflective” surface when the curtains are closed. Using eyelet curtains means it’s a full and luxurious look without costing a fortune for a pair of ready made curtains. Having had them installed last night, our room felt so much warmer and the insulating properties spoke for themselves with much less power being used to retain the heat in the room.

While they are a little long currently, it is so much easier to shorten a pair of ready made curtains than start from scratch.

Curtains are one of those really time consuming things to do yourself, and really needs a dedicated workspace, if you are living with a family larger than one. To look right, they need to be perfectly made, lined for cutting out light and heat loss, and all that is very tricky to get right. The bigger the window, the harder it is. For any window with two curtains, it is at least a day of effort because you do it once in a blue moon unless that is your day job.

Eyelet curtains were our choice because we didn’t want a traditional look in our bedroom, but somehow, they look a bit more polished than tab tops. It is also significantly cheaper than traditional curtains with the heading tape. As we’re happy with the results, if I get a spare couple of weeks off next year, I will buy some fabric and make my own pair. As a quick, cheap, and easy solution pre-made, I’m a big fan.

One thing I didn’t know until this round of decorating, was that you can iron your newly bought and packaged curtains. In fact, where we bought these featured that on the youTube video forming the instructions.

I have always just let them drop. You learn something new every day.

Of course, this is a litle prep before the main work is done, so we have moved some furniture ready for the window to be turned into a French door. It will take a couple of days to do the work and another couple or so for the plaster to go off so we can rehang the curtains for the last time. Let me put it this way, we’ll sleep somewhere else in our home until the room is ready. Then I will share the final, completed look – hopefully having taken a few inches off the bottom of the curtains by then!

OK, I’ll bite, how do you shorten pre-made curtains?

This is the downside to buying pre-made if your window does not fit the “standard” sizes made. Ours didn’t, being a wide but short (comparatively, apparently) French door.

The downside to buying the eyelet curtains is that you have to shorten from the bottom, which I think is much more fiddly to get right.

If you know the curtain will need shortening, before hanging the curtains, take one down to your local haberdashery and find a suitable thread – match a shade darker than the curtain, especially if it is a plain fabric as thread always sews up lighter when the job is completed. Hold the thread against the fabric and check disappears when it is a single strand.

Hang the curtains and see how they drop (so to speak). If not ironing them, leave them to drop the creases, which takes three weeks or so for our set.

With a friendly partner, fold up the bottom of the curtains so you have 5mm or so off the ground. Pin at one end of the fold and repeat the other end of the curtain. Remove the curtain and pull the bottom of the fold tight and pin the curtain in the middle.

Press the fold into the curtain using a damp tea-towel, and pin all the way along. This gives you the line along which you will sew, I don’t tend to cut the curtains down as this makes two jobs and when someone is finished with the curtains, they make great dust sheets for decorating.

Do the sewing. If you have folded the curtains up, the original hem line will give you a straight line along which you can sew. With thicker fabric, I do this by hand, a simple running stitch, ensuring I take out the pins as I go along the line.

Rehang the curtain and do the second one. Here is the results (bear in mind, the creases need to drop out fully).

Bear in mind, anything being done by hand is going to take a while. If the window is wide, you are looking at around ninety minutes a metre, probably longer if you don’t sow regularly. Machine sowing is quicker, between fifteen and forty-five minutes a metre, mostly for the preparation, but if your curtain is thick with a lining, that is not going to be possible on a standard machine.

Hope you have a very cozy and Merry Christmas.

Posted: December 24th, 2025 under 42.

Comments: none