Everyday, it’s a getting closer

As I type this at 07:45 British summer time, we have only just stopped using our battery to supply our power and yesterday we used just 0.6kWh of electricity sourced from the grid. At 26p a unit (I know, I know), that’s a whole £0.16 bought electricity. Which beats Friday, which was a whole £0.25 spent on purchased electricity: that’s for our hot water, travel, everything!

For us, April is a great month, usually, with generation figures between the high 300s and mid 400s kWh. It’s still cold enough to be efficient (solar panels benefit from running a bit chilled, don’t we all?) but the sun is high enough to hit the panels for longer and the leaves are yet to put in an appearance on the trees. This year, we’ve averaged 22kWh a day.

Of course, being chilly means we’re still heating the house, so we’re not quite off grid, and it’s all subject to the weather – clouds at midday make a huge difference to our generation values.

But we’re making the most of it. Keeping our waste quantities down too, we cook much of our own food. Careful selection of the containers used for raw veg means we are keeping our carbon footprint down in more ways than one.

When solar first became available in the UK, I said it would impact gas providers. I didn’t predict heat pumps or the UK government making them mandatory, but by 2014, we weren’t using gas over the summer.

The response to a decreasing market has been for energy providers in the UK to put up electricity prices and keep gas low. Basic A level economics in action here, cut demand by putting up prices and generate it by keeping the price low.

Which is one of the painful things about our power providers being commercial operations rather than government owned – they need to make a profit, with regulation being used to ensure to the UK meets its climate promises. How big a fine makes it worth the cost of obeying the rules?

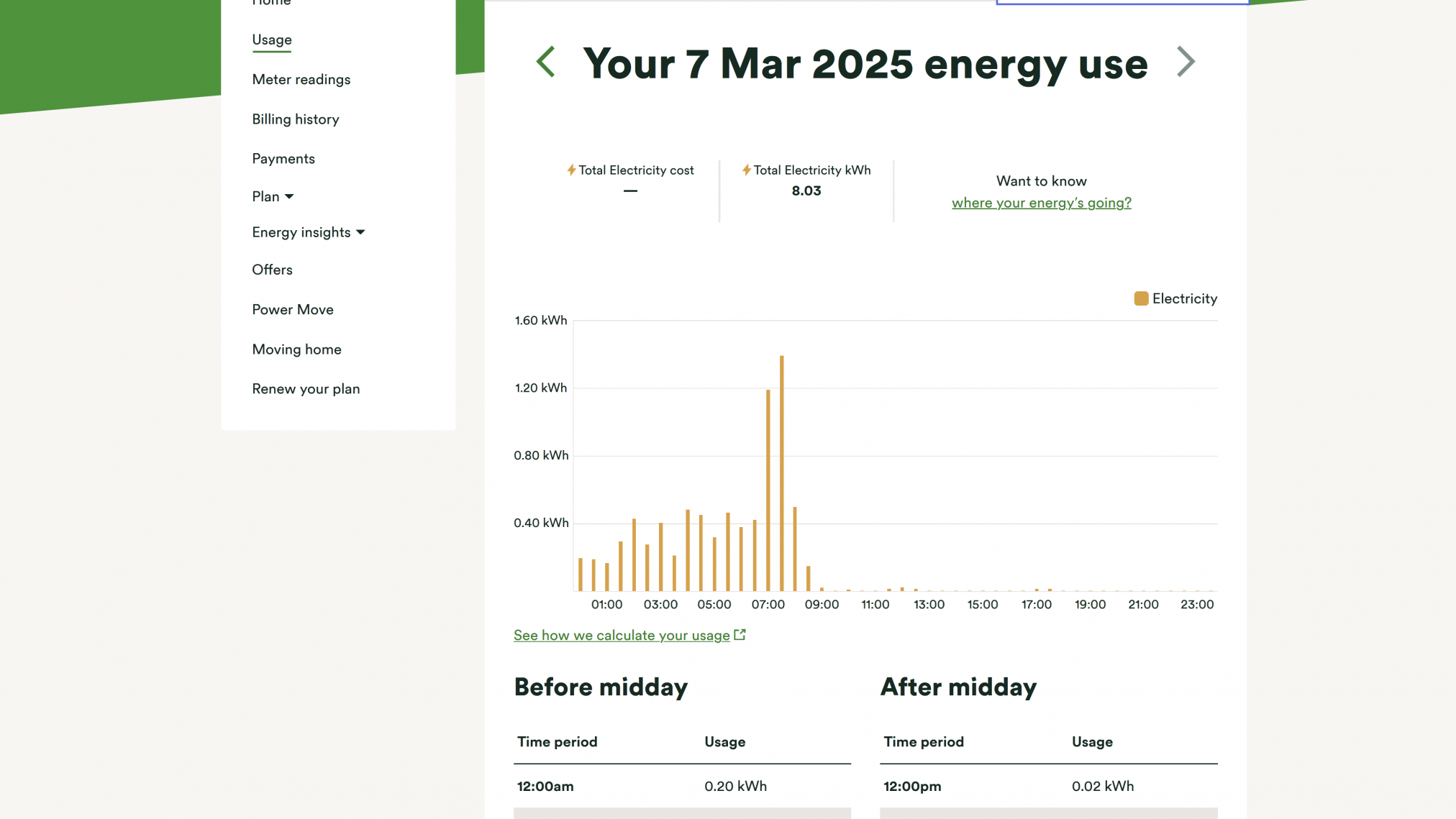

For us, we’re just enjoying the lower costs, because we’re still coming out ahead. From Ovo’s Energy Insights calculator and comparing us to “similar homes” (battery, solar panels, electric car, washing machine, tumble dryer, 2 people, electric cookers, etc), we are consuming roughly half the amount electricity the others are on average?

Which seems odd.

I don’t think we’re being overly careful in our usage. My house is warm: I’m having baths a couple of times a week! We wash our clothes, use the dishwasher. I don’t use chemicals to clean the house – that’s all done by a steam cleaner!

Charging up the car battery does take a load of power: the last time we did it was Tuesday, and that took 7kWh compared to our daily usage of 20kWh. We’re both making more effort to use the car less as the weather has become warmer, at 08:15, it’s a balmy 7°C out there. Even so, my commute on Monday into the local office typically uses that very same 7kWh. I should drive more economically…

A goal to aim for?

As a closing thought, we’re not the only ones to enjoy a good April – 1st April 2025 is the first day the UK reached 12,569MW being generated by solar power.

Posted: April 6th, 2025 under Driving off the grid.

Comments: none