A recession type of mind

I’m trying to avoid the news at the moment. Not because of an osterich type of mind, hide your head and nothing bad is happening – “ta deda tee dah” – but more because I don’t want to make things worse.

What do I mean? Well, at the moment, I am pretty lucky. Everyone in the household is earning and we are all salaried above minimum wage. We have a small amount of debt in the house (a mortgage), which we fixed at 1.22% until next year. We have some savings so if one of us loses our job, we don’t even need to sacrifice our standard of living. The energy rises have not really hurt us.

The trouble is, I have the same feeling of dread at the moment as I would if things were very different. I have been in the position where my rent has suddenly sky-rocketed, bills hurt and heavily dependent on the next pay check.

My mum is having a big clear out and it’s all I can do not to say don’t get rid of that mum, I’ll have it. I quite literally don’t need anything. I’m even fixing up old appliances rather than buy new ones and I have a lovely car – maintaining that is so much cheaper than buying even a second hand one.

In the back of my mind is my dad’s old adage about not having investments while you have debt. Settle the debt then play – if you invest the money for the mortgage and the investment goes sour, you can well find yourself homeless. Pay the debt first.

So, that’s what I’m doing. Our interest rate is low, so I am putting spare money there. It’s great on many levels as it means we’re saving interest on that big debt and we therefore save tax. When we come off the fixed rate, we should (fingers crossed) only have 2 or 3 years of debt left, even if the interest rates go above 15%.

Hopefully, they won’t. But I do remember seeing mortgages advertised for 19% as an apprentice in 1993!

But things don’t actually look at all that bad?

If I’m feeling this way and not being frivolous, who else is? What is the impact of that?

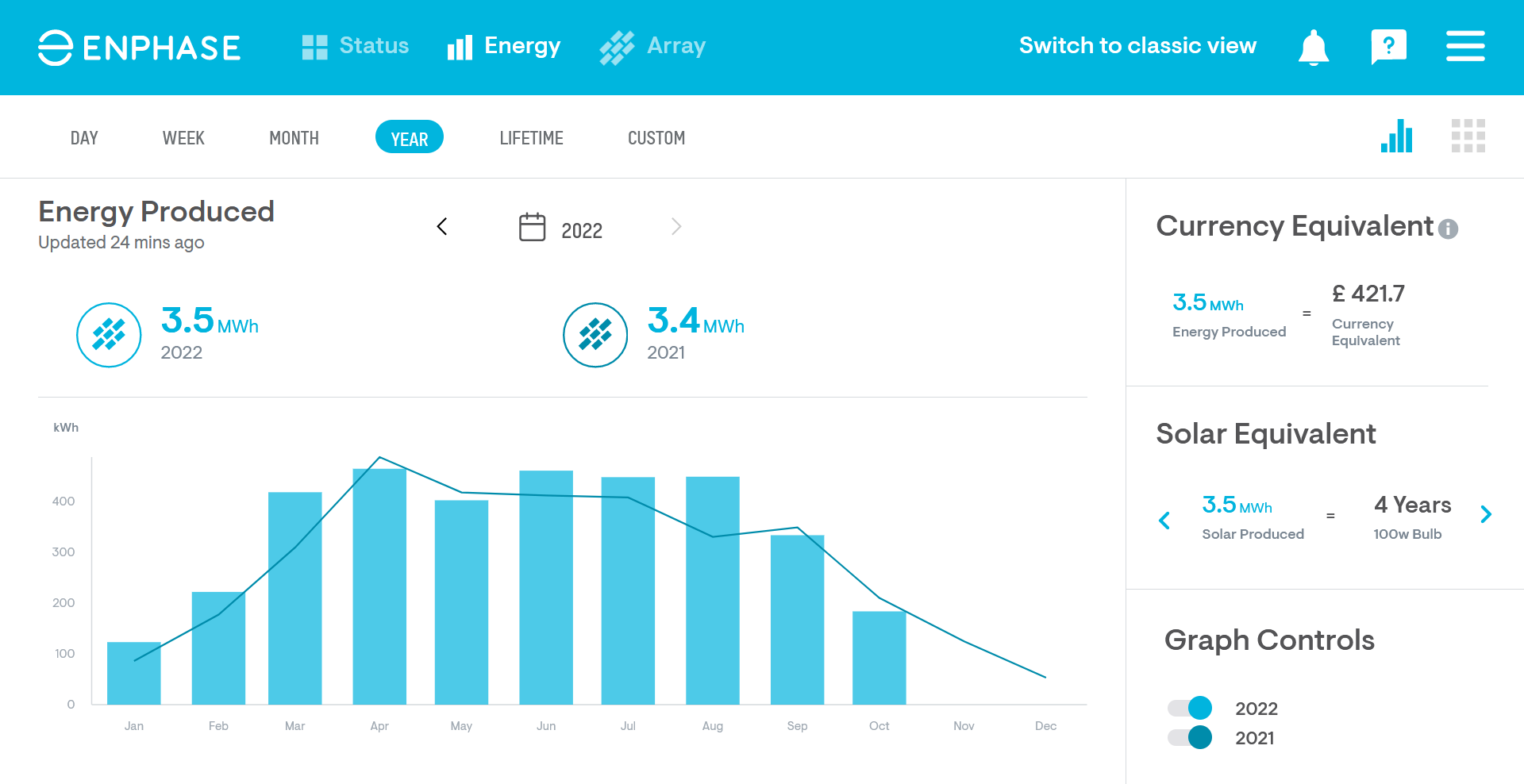

Inflation is not actually a bad thing per se, it depends on the causes. The items that are costing significantly more aren’t things that take up much of my take home paycheck. I had reduced my energy usage over the past 10 years, so we’re cushioned from that. I don’t drive far with the cars, so that’s not a huge cost. Because of lockdown, we are out of the habit of going out – we have a nice house, so it is far from a necessity.

Due to the hot summer, some foods are scarce and/or expensive, but again, not a huge impact for us.

We’ve got all the essential work done on the house and the vehicles. We have a deal not to waste money on gifts on the upcoming season, though Christmas dinner is a bit of a splurge, all round. If it’s a sunny day, well…

It’s tempting to hide away and not spend until it’s all got better. Of course, if everyone does that, we have no growth. Retail and manufacturing all suffer, leading to job losses.

Let’s look at our household budget again… And avoid the news…

Posted: November 20th, 2022 under 42.

Comments: none